Why Your Paper Superbills Are Costing You a Fortune?

- Soendeep Kaur

- Sep 8, 2025

- 3 min read

Let’s be honest, you became a doctor to help people, not to chase down paperwork. Yet, for many private practices, the dreaded paper superbill is a daily ritual—a stack of forms waiting to be filed, faxed, or processed. It feels like the way things have always been done, but what if that "tried and true" method is actually a silent drain on your practice’s revenue?

We recently started working with a provider who was dedicated to their patients but was losing thousands of dollars every month without even realizing it. Their process was simple: they'd fill out a paper superbill for each patient, and the front office would fax a stack of them to the billing company at the end of the day.

The problem? The fax machine was a silent saboteur.

The Paper Problem: A Hidden Revenue Leak

Here’s a snapshot of the costly chaos this paper-based system created:

The Vanishing Superbills: We noticed we were consistently receiving 20–30% fewer superbills than the number of patients seen. It turned out the fax machine was jamming or scanning two pages at once, only sending one. Dozens of superbills—and the payments they represented—were never making it out the door.

The "We Forgot" Factor: One week, the front office team got swamped and completely forgot to fax the superbills. A week's worth of claims sat on a desk, collecting dust. By the time we discovered the issue, we were facing a potential timely filing issue with certain insurers—meaning no payment at all.

The Overwhelm Effect: When we sent a list of missing superbills for them to resend, the task felt too large and stressful for the busy front office staff. The list was never fully completed, leaving more claims unfiled and more money on the table.

This wasn't an issue of laziness. It was a problem of process. The system was prone to human error and machine failure, making it impossible to ensure every patient encounter was billed. The doctor was seeing patients, but a significant portion of their work wasn't turning into revenue.

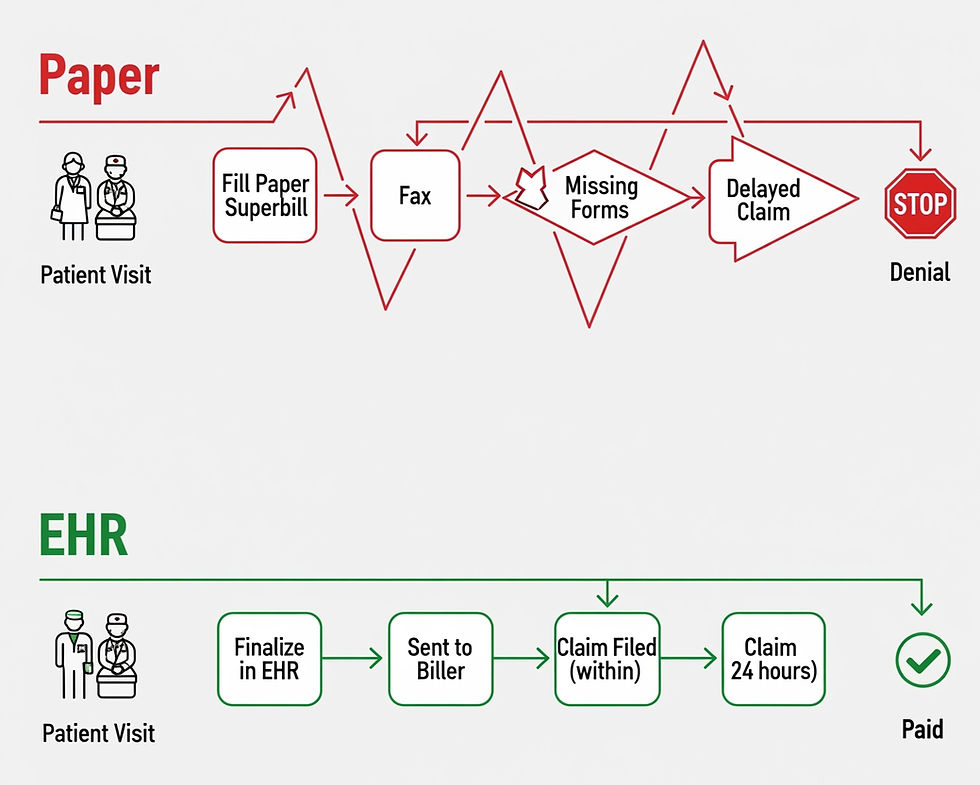

The Digital Solution: Your EHR as a Revenue Engine

To fix the problem, we implemented a simple, powerful change: we moved superbill creation and submission entirely into the practice's EHR (Electronic Health Record) system.

This single change had an immediate and dramatic impact on the practice’s financial health:

Zero-Touch Submission: The front office no longer had to manually fax anything. The doctor simply finalized the superbill in the EHR after the visit. The superbills were then sent to us digitally, instantly and securely. This eliminated human error and machine failure from the process entirely.

Ironclad Record-Keeping: Every superbill is now permanently linked to the patient's record in the EHR. There’s no risk of a form getting lost, misfiled, or damaged. All the data is centralized and accessible whenever it's needed.

Unbreakable Revenue Cycle: We now receive 100% of the superbills for every patient seen. This allows us to submit claims within 24–48 hours of the patient visit. This speed is critical for reducing denials and getting paid faster.

The result? This one small shift to a digital superbill system increased the provider’s revenue by a staggering 25% within the first few months. The money was always there—it was just trapped in a broken, manual process.

Is Your Practice Trapped in Paper?

If your practice still relies on paper superbills, it’s time to ask yourself if it's truly a reliable system. The time and money you think you're saving by not modernizing could be costing you a significant chunk of your annual revenue. The most efficient revenue cycle is the one that's least dependent on a stack of paper.

Question for readers: How much of your practice’s billing process still relies on physical paperwork? What's one step you could take this week to digitize it?